Market springs back to life supported by underlying demand

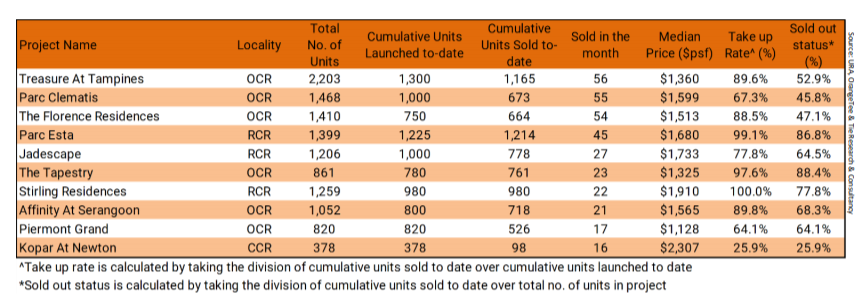

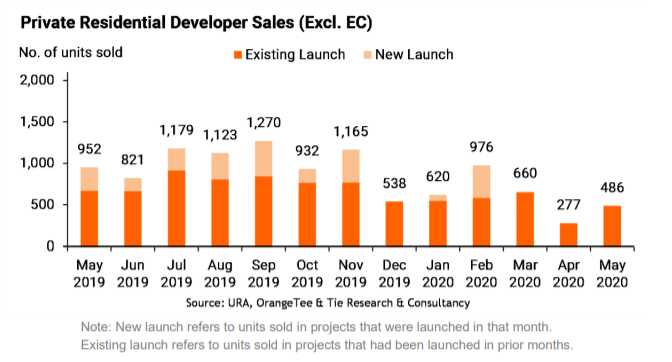

Singapore’s property market sprang back to life as new home sales posted a surprise increase last month. According to the developers’ sales survey by the Urban Redevelopment Authority, new home sales spiked 75.5 per cent from 277 units in April to 486 units in May. Including executive condominiums (EC), sales jumped 73.7 per cent from 293 units to 509 units over the same period. However, the sales volume was still lower than the 952 units sold last May.

Last month’s returning demand exceeded market expectations given the ‘unprecedented’ levels of economic uncertainties and the Circuit Breaker measures. The unexpected sizzling sales came as a welcome relief to many in the industry. New home sales took a significant beating in April as the property market struggled to maintain its usual sales activities after measures meant to contain the coronavirus took hold. Potential buyers could only rely on virtual home viewings to make purchase decisions since all show flats were closed as part of the safe distancing measures.

May’s sales appear to be largely driven by locals and investors. According to URA realis data downloaded today, the proportion of non-landed new homes bought by Singaporeans rose from 84.1 per cent in April to 84.8 per cent in May. By absolute numbers, the number of non-landed homes bought by Singaporeans spiked 81.1 per cent from 222 units in April to 402 units last month. Foreigner purchases had similarly strengthened last month as the number of non-landed new homes bought by permanent (PR) and non-permanent residents (non-PRs) surged 71.4 per cent from 42 units in April to 72 units in May.

Number of non-landed home sales by residential status

2020 | Singaporean | Foreigner (PR+NPR) | Total |

April | 222 | 42 | 264 |

May | 402 | 72 | 474 |

m-o-m % change | 81.1% | 71.4% | 79.5% |

2020 | Singaporean | Foreigner (PR+NPR) | Total |

April | 84.1% | 15.9% | 100.0% |

May | 84.8% | 15.2% | 100.0% |

Source: URA, Orange Tee & Tie Research & Consultancy

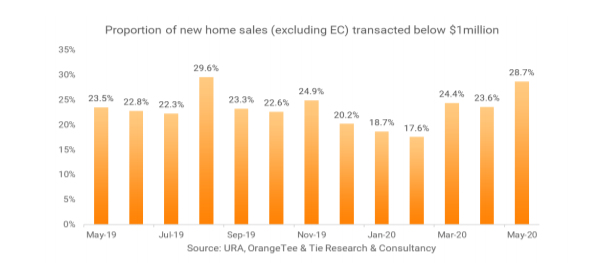

There seem to be more investors entering the market as sales of smaller or lower-priced units soared last month. These private homes tend to be more popular among investors given their affordability and attractive investment yield. Last month, the number of smaller units (excluding EC) below 800 sqft rose by a whopping 70.0 per cent to 319 units in May from 188 units in April. On a similar note, the proportion of private home sales excluding EC below S$1 million increased from 23.6 per cent in April to 28.7 per cent in May, which was the highest proportion recorded since August 2019 (29.6 per cent).

Recent reports of affluent buyers picking up super-luxury homes in Singapore could have fuelled the optimism among many investors. Some investors may be making a purchase now for ‘fear of losing a good deal’. They could be expecting prices to recover since the coronavirus outbreak is abating in some countries and many major economies are reopening gradually. Others could be enticed by the attractive pricing of some private homes as developers have generally adopted a measured approach in their pricing strategies.

There are some encouraging signs in this month’s new home sales numbers. According to URA Realis data, 155 new homes excluding ECs have already been sold in the first seven days of June, which is more than half the 277 units inked in April. Nonetheless, we should observe the market a while more to ascertain if the market is indeed on the road to recovery.

Month | Sales Volume | Launches | ||

(Excl. EC) | (Incl. EC) | (Excl. EC) | (Incl. EC) | |

May-19 | 952 | 952 | 1,394 | 1,394 |

Dec-19 | 538 | 551 | 370 | 370 |

Jan-20 | 620 | 640 | 598 | 598 |

Feb-20 | 976 | 1,315 | 933 | 1,429 |

Mar-20 | 660 | 904 | 578 | 1,126 |

Apr-20 | 277 | 293 | 640 | 640 |

May-20 | 486 | 509 | 615 | 615 |

m-o-m % Change | 75.5% | 73.7% | -3.9% | -3.9% |

y-o-y % Change | -48.9% | -46.5% | -55.9% | -55.9% |

Source: URA, OrangeTee & Tie Research & Consultancy