Download pdf version here.

- HDB Resale Price Index remained unchanged amid the pandemic and economic uncertainties.

- Although the number of resale transactions declined 7.0 per cent quarter-on-quarter (q-o-q) in Q1 2020, it is the highest first-quarter sales recorded in 8 years.

- Price of flats in non-mature estates rose last quarter.

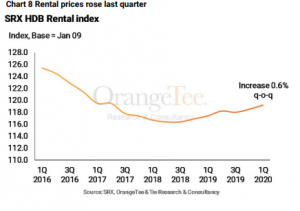

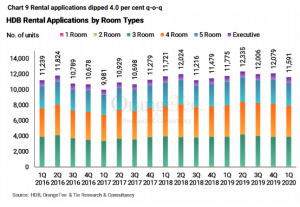

- Rents rose 0.6 per cent q-o-q while the number of rental applications fell 4.0 per cent.

- Fewer small flats were transacted in Q1 2020.

HDB resale price index remained unchanged amid the current pandemic

The price recovery of HDB resale flats was brought to an abrupt halt amid the pandemic and global economic uncertainties. According to HDB public housing data, the HDB Resale Price Index was flat last quarter when compared to the preceding quarter (Chart 1).

Previously, the overall price index rose two consequent quarters by 0.5 and 0.1 per cent in Q4 and Q3 of 2019 after a number of policy changes were made last year to enhance the housing affordability for buyers and improve demand of flats. Some of the changes include allowing buyers greater flexibility in using CPF to buy older flats, enhancing the CPF Housing Grant, rising the income ceiling and allowing larger home loans for eligible buyers.

While housing demand could slow down further if the pandemic continues to drag on, prices of HDB resale flats may not correct excessively in the coming months. HDB resale prices are usually not subjected to volatile swings as most people purchase flats for their own occupation and not for speculation. In fact, major price fluctuations had been few and far between in recent years, with the q-o-q price change ranging between a narrow band of -1 and 1 per cent over the past 20 quarters.

Further, the number of home owners defaulting on their housing loans may also not be high. A number of measures had been put in place to instil financial prudence among borrowers and ensure the property market is well grounded in market fundamentals. For instance, financial institutions need to certify that borrowers are within the thresholds of the mortgage servicing ratio when extending a housing loan under the Mortgage Servicing Ratio (MSR) rules. Currently this is being capped at 30 per cent of a borrower’s gross monthly income for housing loans for the purchase of an HDB flat or an executive condominium bought directly from a developer.

According to the first quarter public housing data released by HDB, the total resale volume declined 7.0 per cent to 5,893 units in Q1 2020 from 6,339 units in Q4 2019 (Chart 3). However, on a year-on-year basis, resale volume rose 21.9 per cent.

Demand had remained buoyed prior to the onset of the pandemic, indicating that the policy changes were effective in boosting the housing market last year.

In fact, based on caveat records from another official source at data.gov.sg, 5,531 caveats were recorded for Q1 2020. This is the highest first-quarter resale volume inked in 8 years and above the 8-year average of 4,195 units (Chart 4). In tandem with more flats reaching their five-year Minimum Occupation Period in non-mature estates, the number of non-mature resale flat transactions rose higher at 26.7 per cent y-o-y (year-on-year) when compared to the 17.4 per cent recorded for mature estates in Q1 2020.

According to HDB quarter 1 public housing data, fewer small flats were sold in Q1 2020 when compared to the preceding quarter. Last quarter, there were 1,531 resale applications for 1-, 2- and 3- bedroom flats, a 10.2 per cent decline from the 1,704 applications received in Q4 2019 (Chart 5). Conversely, the number of resale transactions for larger flats like 4-, 5- bedroom and executive units fell by a smaller magnitude of 5.9 per cent over the same period from 4,635 resale applications in Q4 2019 to 4,362 in Q1 2020.

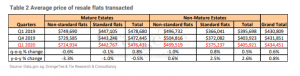

Using information from data.gov.sg, the average price of both non-standard and standard flats in mature estates dipped 0.6 per cent and 0.1 per cent q-o-q in Q1 2020 (Table 2). On a yearly basis, prices slipped by -3.3 and -1.0 per cent y-o-y for non-standard and standard flats. Conversely, prices of both flat types rose in the non-mature estates, possibly due to their longer balance lease. Prices increased 0.5 per cent q-o-q and 2.6 per cent y-o-y. Standard flats in non-mature estates have also increased on a quarterly (0.8 per cent) and yearly (2.5 per cent) basis.

MATURE ESTATES

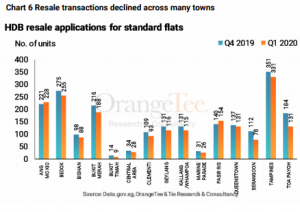

Resale transactions of HDB flats fell across most mature estates last quarter. Toa Payoh saw the largest decrease of 53 units from Q4 2019 to Q1 2020. . Last quarter, Pasir Ris and Ang Mo Kio were the only towns with a q-o-q increase in resale volume (Chart 6).

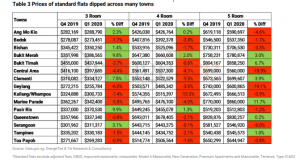

Prices of standard flats had similarly dipped across many towns last quarter (Table 3). Bedok, Central Area, Geylang, Kallang / Whampoa, and Toa Payoh saw resale prices fall across the 3-, 4-, 5-room types in Q1 2020. Bukit Merah was the only town which saw prices increase across all three flat types.

NON-MATURE ESTATES

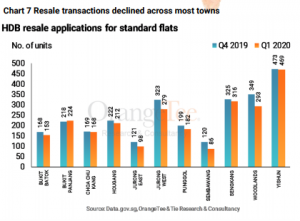

Resale transactions dipped across most towns except Bukit Panjang in Q1 2020 (Chart 7). Some of the larger declines could be observed in Woodlands, Jurong West and Sembawang.

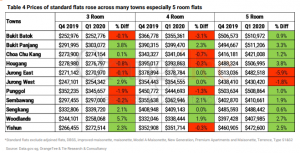

The weaker sales volume came on the back of an increase in resale prices across many towns last quarter (Table 4). For instance, prices of 3-, 4-, 5-room types rose in Bukit Panjang, Sengkang and Woodlands in Q1 2020. Prices of 5 room flats had also increased for most non-mature estates except Jurong East and Jurong West.

RENTAL

According to SRX Rental Index, rents rose 0.6 per cent q-o-q (Chart 8). However, the number of approved applications to rent out HDB flats fell by 4.0 per cent from 12,079 units in Q4 2019 to 11,591 units in Q1 2020.

Compared to Q1 2019, the number of approved applications was also 1.6 per cent lower from the 11,775 units (Chart 9). The drop in applications could be attributed to fewer owners planning to lease out their units in light of the current pandemic. Some may prefer to lease their flats after the pandemic subsides to avoid a potential virus spread in their units.

While the economy may take a while to be back on regular footing given the scale of the pandemic outbreak, property sales may pick up speed and regain some momentum when the crisis subsides and safe distancing measures are gradually eased. Genuine buyers and those with urgent housing needs may return to the market when flat viewings resume.

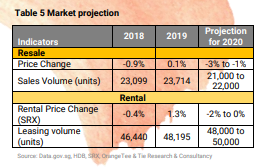

The price affordability of HDB flats may be deemed attractive to some buyers, especially those who prefer a cheaper housing option or a smaller housing loan in light of the current economic uncertainties. The number of resale transactions could be slightly lower than last year. We estimate that around 21,000 to 22,000 units could be sold in 2020 (Table 5).

Overall price of resale flats may enter the negative territory should the health crisis persist and unemployment creeps up. However, the property value of some flats may hold steady in areas with higher demand such as those located near MRT stations, amenities or city centre.